Frequently Asked Questions for Shareholders

Below you will find the answers to common questions about your shareholding. Please take some time to look through the answers.

Who is Celtic plc’s Registrar and what is their function?

A: Celtic plc’s Registrar is Computershare Investor Services plc (“Computershare”).

Computershare maintains Celtic plc’s share register (also known as the register of members) on their behalf – this register contains the names and addresses of all Celtic plc shareholders and the number of shares each shareholder owns.

The Registrar updates the register when you advise them that your personal circumstances or shareholding change, and sends out shareholder payments, share certificates and Celtic plc’s annual report and accounts. By law, the register is a public document which the Registrar must make available for inspection.

You can manage your Celtic plc shareholding online by registering to use the Investor Centre, a free and secure online resource managed by, Computershare. The Investor Centre is available 24 hours a day, 365 days a year.

To register, simply visit the Investor Centre, https://www-uk.computershare.com/investor/ and enter your Shareholder Reference Number (SRN), which can be found on your Share Certificate, and your registered address.

Access

Once registered, you will be given instant access to:

- View portfolio balances and the market value of all your holdings registered with the Registrar

- Register to receive electronic shareholder communications

- Download forms

- Vote online at Celtic plc’s Annual General Meetings

The Registrar will also send a unique activation code to your registered address.

Activation Code

On entering your activation code, you will have further access to:

-

- Update your bank details

- Update your registered address

- Access your electronic statements

- View your transaction history

Registrar Contact Details

Shareholders who prefer not to manage their shareholding online can contact the Registrar’s Celtic plc team directly at:

Computershare Investor Services plc

The Pavilions

Bridgwater Road

Bristol, BS99 3FA

Tel: 0370 702 0000

You can also find more information at https://www.computershare.com/uk

How do I view my shareholding?

A: You can view your Celtic plc shareholding, including the number and class of shares held, online by registering to use the Investor Centre, a free and secure online resource managed by Celtic’s Registrar, Computershare.

To register, simply visit the Investor Centre and enter your Shareholder Reference Number (SRN) and registered address. If you do not have your SRN, please refer to the ‘Where can I find my shareholder reference number (SRN)?’ section below.

What should I do in the event of the death of a Celtic shareholder?

Deceased Shareholders

If you are the executor of the estate of a deceased shareholder you will need to notify the registrar, Computershare Investor Services PLC, and provide them with certain documents – usually this will be an original or official copy of the death certificate and/or a sealed or certified copy of the Grant of Representation. If you require any assistance in notifying Computershare, please email investorrelations@celticfc.co.uk.

Joint Accounts

Where it is a joint account the death certificate is all that is required. When the death certificate is received the deceased holder’s name is removed from the account leaving the remaining holder(s) against the shareholding. You will also need to return the current share certificate(s) so it can be reissued in the new names.

Single Accounts

If the account is held by one shareholder only then the death certificate should be provided to the registrar to notify them of the death as soon as possible. This does not complete the registration process, but due to the length of time it takes to go through probate it is worth having this step in place as soon as you can. On receipt of the death certificate, they will make a note on the register and write to the executor/person that notified them to confirm what else is required.If the estate already has probate, then there is no need for the death certificate at all.

If the small estate facility is to be used, you will need to confirm this (i.e., there is no probate and that you want to use small estates) and supply the death certificate as well.

For further information, we recommend that you visit Computershare’s website and view their help section.

If you believe someone may have left you shares in Celtic plc, but have not yet received any communications regarding this, please speak to the deceased’s appointed legal representative.

Neither The Celtic Trust, Celtic plc nor the Registrar, Computershare, can advise on such matters and cannot progress without instructions from the deceased’s legal representatives.

How will I receive shareholder communications?

A: Celtic plc’s default method of communicating with shareholders is by website communication. This not only reduces printing and mailing costs but also reduces the environmental impact usually associated with paper communications. The most economical and environmentally friendly way of receiving company documents is to provide Computershare with your email address. If you do not provide an e-mail address you will receive a written notification from Celtic plc that the Annual Report and the Notice of Annual General Meeting are available to view and download from the website.

Shareholders who prefer to receive paper copies of these documents can register this preference by contacting the Registrar, Computershare.

If you have not been receiving communications from Celtic, it is likely that the contact details held for you are now out of date. If you have registered with Computershare’s Investor Centre, you can amend your contact details online. If you are not registered, please contact Computershare to update your records.

What should I do if I have not been receiving my dividend communications?

A: If you have not been receiving communications from Celtic or Computershare, including communications relating to your dividend payments, it is likely that the contact details that they hold are now out of date.

If you have already registered with Computershare’s Investor Centre, you can amend your contact details online. If you are not registered, please contact Computershare to update your records.

I have lost/never received the cheque relating to a previous dividend payment or cannot cash an old cheque because it is now out of date – can I get a replacement?

A: Please contact the Registrar, Computershare, for assistance. Replacements can only be issued as a cheque.

There may be a charge applied for issuing replacement cheques, so shareholders are advised to ensure their contact details are up to date and/or have these payments paid directly into their bank account.

What are the key events for shareholders each year?

June: Celtic plc’s year-end is 30 June.

August: An annual dividend payment is made (or Ordinary shares issued if the SCRIP Dividend Scheme is selected) to holders of Convertible Cumulative Preference Shares, usually in late August.

November/December: The AGM is generally held in late November.

-

- Please note that the above dates are subject to change.

Can I attend shareholder meetings?

A: Holders of Ordinary Shares and Convertible Preferred Ordinary Shares will be invited to attend the AGM. If there is a particularly important matter to decide that cannot wait until the next AGM, an Extraordinary General Meeting (EGM) may also be called.

Holders of only Cumulative Convertible Preference (“CCP”) Shares would not be entitled to attend and vote at either AGMs or EGMs unless a matter which sought to vary the rights attached to the CCP Shares is being voted on.

What happens at the Celtic plc AGM?

The notice calling the meeting will invite relevant shareholders to attend and vote on important matters such as the adoption of the annual report and the directors’ remuneration report and the reappointment of directors and auditors. Shareholders will be given a presentation on Celtic plc’s performance and prospects and will have the opportunity to ask questions of the Celtic plc Board (as per the process explained in the relevant Notice).

Generally, all substantive resolutions are decided on a poll, meaning that each shareholder present (including by proxy, see below), has one vote for every Convertible Preferred Ordinary Share and Ordinary Share owned. Convertible Cumulative Preference Shares generally do not carry the right to vote unless a matter which sought to vary the rights attached to the CCP Shares is being voted on.

Resolutions may also be passed by show of hands meaning that every member present holds one vote. The proxy votes and those cast in person at the meeting are counted by the Registrar, Computershare, and checked by independent scrutineers. The results of all poll votes are published on the Celtic website.

What happens if I am unable to attend the Celtic plc AGM?

A: If you are unable to attend any general meetings of Celtic plc, you can appoint someone to attend and vote on your behalf (known as your ‘proxy).’ Your proxy can be any person you choose. If you appoint the ‘Chairman of the Meeting’ you can be certain that your votes will be counted on any poll as the meeting cannot proceed without a chairperson present. You can instruct your proxy to cast your vote on each resolution according to your specific instructions, or else leave the vote at his or her discretion.

You can appoint a proxy by completing and returning the form that will be sent to you before the meeting. You will also be given instructions as to how to proxy your vote electronically.

How do I proxy my votes to the Celtic Trust?

A: It is easy to proxy your votes to the Celtic Trust, but proxying your vote is not a once-and-for-all process. At each AGM or EGM you will be sent information and this will include a form or link to allow you to proxy your vote. You retain ownership of the shares but you are, in effect, lending us your vote for each meeting that you do this. We post specific guidance closer to the time of AGMs.

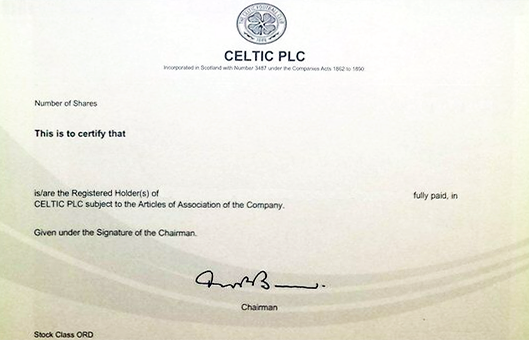

What should I do with my share certificate?

A: The Share Registrar, Computershare, will issue you with a share certificate stating the number of shares you own. Share certificates are evidence of your ownership and should be kept in a safe place. You will need them if you want to sell all or some of your shares in the future. Share certificates are posted to shareholders at their own risk.

Where can I find my shareholder reference number (SRN)?

A: Your SRN is an 11-digit number, which usually starts with the letter ‘C’ and can be found on the right-hand side of your share certificate if it was issued by the Registrar, Computershare. You should quote this number in all communications with Computershare.

Your SRN can also be found on most communications sent by Computershare such as your Form of Proxy ahead of each AGM and any dividend cheques or associated dividend confirmations.

If you cannot find your SRN, you should contact Computershare.

Share certificates issued in 1994 and 1999 prior to the appointment of Computershare will not contain an SRN. In this instance, you should contact Computershare who will post your SRN to you at the address held on their records.

Why do I have two different shareholder reference numbers (SRNs)?

A: If you purchase further shares in Celtic, but the name and address you supply to Computershare differs, even slightly, from the existing details held, another shareholding might be created. If this happens and you want the shareholdings combined you should contact Computershare, otherwise you may receive more than one copy of Celtic shareholder documents.

I have more than one share certificate. Can they be combined?

A: If you have several Celtic share certificates (of the same stock) you can ask for your certificates to be consolidated into one. However, there is a fee for this service. Please contact the Registrar, Computershare, for further details.

I have lost my share certificate – what do I need to do?

If you have lost your share certificate you should report this to the Register, Computershare, immediately by calling 0370 703 0192. Computershare will update the shareholder register and arrange for a ‘stop’ to be placed on the missing share certificate. Please check carefully before reporting your share certificate missing as there may be a charge to issue a replacement share certificate and once a share certificate has been reported as lost it cannot be reinstated if it is subsequently found.

What if I do not have a share certificate and I hold my shares electronically in an online share dealing account?

If you are holding your shares electronically in an online share dealing account, then please bear in mind that your account is subject to the terms and conditions of your account provider. When Celtic announces an event that requires an instruction from you as a shareholder, your provider should contact you setting out the options available to you and the closing date to submit any instruction. If you have a question about your account or if wish to attend and vote at General Meetings you should contact your own account provider.

What should I do if I change my name, address, or bank details?

If you have registered with Computershare’s Investor Centre you can amend your address and bank details online. If you are not registered, you should write to Computershare with your updated details quoting both your old and new address and your Shareholder Reference Number (SRN).

To change your name, you will need to write to Computershare enclosing a copy of your marriage certificate or other relevant legal document. Unfortunately, this change cannot be registered online.

Can I have payments paid direct into my bank or building society account?

A: Yes. Firstly, you need to complete a Bank Mandate form where you can enter your bank account details. You can obtain this form from the Registrar, Computershare, and it can also be downloaded direct from the downloadable forms section of the Computershare Investor Centre website.

What classes of shares are on the Celtic plc register?

A: There are three tradeable classes of shares on the Celtic plc register listed on the AIM Market of the London Stock Exchange, each of which holds different rights:

Ordinary Shares of 1p each: Ordinary Shares hold voting rights and participate in ordinary dividends, if declared. Holders of Ordinary Shares may attend, speak, and vote at the Annual General Meeting.

Convertible Cumulative Preference (“CCP”) Shares of 60p each: CCP Shares do not hold voting rights but pay an annual fixed dividend of 3.6 pence per share (6% of the nominal value). CCP Shares can be converted into Ordinary Shares on a one for one basis. Holders of CCP Shares alone cannot attend, speak, or vote at the Annual General Meeting.

Convertible Preferred Ordinary (“CPO”) Shares of 100p each (CPO): CPO Shares hold voting rights and participate in ordinary dividends, if declared. CPO Shares can be converted into Ordinary Shares on a 2.08 for one basis. Holders of CPO Shares may attend, speak, and vote at the Annual General Meeting.

Celtic plc also has in issue, Deferred Shares of 1p each which hold no voting or dividend rights and are issued for nominal value balancing purposes only following the conversion of CCP or CPO Shares.

You can obtain the current market price of the Company’s shares by going to the London Stock Exchange website at https://www.londonstockexchange.com/stock/CCP/celtic-plc/company-page

Were my Shares subdivided after I purchased them?

A: This would depend on when you purchased your shares. In September 1998, a resolution was passed to split the issued Ordinary and Preference Shares in the ratio of 100 to 1. This meant that each holder of 1 Ordinary Share automatically now held 100 Ordinary Shares of 1p and each holder of 1 Preference Share now held 100 Preference Shares of 60p. No new share certificates were issued at this time and old certificates continue to be valid x100.

The most commonly purchased package in the 1994 Offer and Placing was for 5 Ordinary and 5 Preference Shares, which today would equate to 500 Ordinary Shares and 500 Convertible Cumulative Preference Shares.

If you have any questions relating to the number of shares you may now hold, this can be checked with our Registrar, Computershare.

What do the terms ‘ex-entitlement’ and ‘record date’ mean?

A: When Celtic plc calculates its shareholders’ entitlement to the dividend it captures the shareholder register on a pre-determined date, known as the Record Date. This uses the number of shares that you hold on this day to calculate your payment.

Before announcing each dividend, and in consultation with the London Stock Exchange, Celtic plc sets a date on which the shares will be sold without an entitlement to a payment. This is known as the “ex-entitlement date” and means that the buyer is not entitled to receive the next dividend payment. Shares sold prior to this date are said to be “cum-entitlement” which means that the buyer is entitled to receive the next dividend payment, even though their name may not appear on the shareholder register on the Record Date.

If you buy or sell Convertible Cumulative Preference Shares and are unsure as to whether you are entitled to receive the dividend, contact the broker who acted on your behalf and who will be able to tell you if your shares were cum-entitlement or ex-entitlement.

How do I Convert Convertible Preferred Ordinary Shares and Convertible Cumulative Preference Shares to Ordinary Shares?

A: On 1 September 2007, Cumulative Convertible Preferred Ordinary Shares of 100p (“CPO Shares”) and Convertible Cumulative Preference Shares of 60p (“CCP Shares”) each became convertible, at the instance of shareholders, into Ordinary Shares of 1p each (“Ordinary Shares”).

The conversion rate that will apply to all conversions has been fixed under Celtic plc’s Articles of Association at 2.08 Ordinary Shares for each CPO Share and 1 Ordinary Share for each CCP Share. Deferred Shares of 1p each will also be issued for nominal value balancing purposes only.

How can I transfer or gift shares to someone else?

A: You do not always need to use a bank or stockbroker to buy, sell or gift shares. If the buyer and seller agree between themselves, they can transfer shares ‘off market’ by using a stock transfer form. This must be sent to our Registrar, Computershare, together with the share certificates.

A Stock Transfer form is available on the Computershare website on the ‘Downloadable forms Section.’

It is the responsibility of the shareholder to seek independent legal and/or financial advice in relation to the sale or transfer of shares to someone else.

How do I buy and sell shares on the market?

A: Celtic PLC’s Registrar, Computershare, offers internet, postal and telephone dealing services.

More information on the Computershare service, including costs and contact details, can be found at https://www.computershare.trade/

Investors can also use a stockbroker, bank or building society to buy or sell shares in the secondary market. The commissions charged for buying and selling shares vary between the different organisations. If you do not know a stockbroker, you can contact The Association of Private Client Investment Managers and Stockbrokers (APCIMS) on +44 (0)20 7247 7080. Or you can obtain details of stockbrokers all over the UK who deal with private investors on their website at www.apcims.co.uk. You should always use a stockbroker authorised by the Financial Conduct Authority.

It is the responsibility of the shareholder to seek independent legal and/or financial advice in relation to the purchase or sale of shares.

Do I need to produce my share certificate when I sell my shares?

A: Before selling Celtic plc shares, you must ensure that you have a valid share certificate in your possession. Please refer to the lost share certificate section if you do not have valid share certificate(s).

If you cannot supply a valid share certificate after a sale has taken place on your behalf, the broker may have to carry out a ‘share buy-back’. This means that the broker will purchase shares on the market in order to fulfil the sale that they have carried out on your behalf. If the broker must do this, then they will charge you for any costs that they incur.

Will I be liable for any taxes or duties when buying, selling, or transferring shares?

A: Neither the Celtic Trust, Celtic plc nor the Registrar, Computershare, can advise individuals on matters relating to applicable taxes and/or duties. If you require further assistance, please consult your financial advisor.

I have heard about boiler room scams. What are they and how can I tell if an unsolicited call is genuine?

A: Some Celtic shareholders have received unsolicited telephone calls from companies offering to buy shares in Celtic plc on very favourable terms.

The calls come from overseas ‘brokers’ who are very persuasive, extremely persistent and often have professional websites and telephone numbers to support their activities. These callers will sometimes imply a connection to Celtic and provide incorrect or misleading information about Celtic.

This type of call should be treated as an investment scam – the safest thing to do is hang up.

If you have already been approached you can report this matter to the Financial Conduct Authority (FCA) by downloading and completing the share fraud reporting form or by calling 0800 111 6768. If you wish to inform Celtic of any approach, you can do so by emailing investorrelations@celticfc.co.uk.

Shareholders should be extremely wary of any unsolicited advice, offers, approaches or other communications regarding their shares and/or personal information.

The Financial Conduct Authority (FCA) has found most share fraud victims are experienced investors who lose an average of £20,000, with around £200m lost in the UK each year.

Avoiding Scams

- Do not get into a conversation and make sure you get the correct name of the person and organisation contacting you and then end the call.

- Check the Financial Services Register to see if the person and firm contacting you are properly authorised by the FCA.

- Beware of fraudsters claiming to be from an authorised firm, copying its website or giving you false contact details.

- Search the list of unauthorised firms

For further information on how you can avoid being a victim of share fraud visit the FCA website.

The FCA have produced useful advice about how to protect yourself from unsolicited communications concerning investment matters which you can download from the FCA website.

Keeping Your Details Safe

Keep your Shareholder Reference Number and Investor Centre Username and Password safe and secure, in the same way you would for your bank account details and PIN.

Remember: Do not share your personal shareholder details with any unexpected callers.

I think my Supporters Association may have held shares in Celtic plc, what do we do?

A: If you believe your Supporters Club may hold, or have held, shares, we recommend that you speak to your Supporters Club in the first instance, or alternatively to the Registrar, Computershare, who will assist you where possible. Prior to getting in touch, please ensure you have as much information about the shares as possible, including the approximate date of purchase, the number of shares purchased and the name of any individual(s) who may have represented your Supporters Club or managed the shares on its’ behalf.

What are the details of the Scrip Dividend Scheme?

A: The terms and conditions of the Celtic Scrip Dividend Scheme in which shareholders in the Company can elect to receive dividends payable on Preference Shares by way of an issue of new Ordinary Shares in the Company are set out below.

The Scrip share price is the average closing middle market quotation of Celtic PLC’s Ordinary Shares over the five dealing days starting with the relevant ex dividend day.

2021 Scrip Share Price

The price at which such shares were or will be issued for 2021 are – 111p

Individual shareholders who have elected to participate in the scrip dividend scheme are reminded that if they have any queries in respect of the personal tax consequences of their participation in the scrip dividend scheme, they should seek personal tax advice from a qualified adviser.

In particular and with reference to condition 18 of the Celtic Scrip Scheme Terms and Conditions, it is worthwhile noting that in respect of recent issues of Ordinary Shares pursuant to the Scheme, the cash equivalent of the New Ordinary Shares on the first day of dealings on AIM has been more than 15 % higher than the value of the cash dividend foregone. This may give rise to specific tax consequences and participants in the Scrip Scheme should take advice accordingly.

For all enquiries regarding the Scheme and Scrip Dividend Mandate, contact Computershare Investor Services on 0370 702 0192.